south dakota motor vehicle sales tax rate

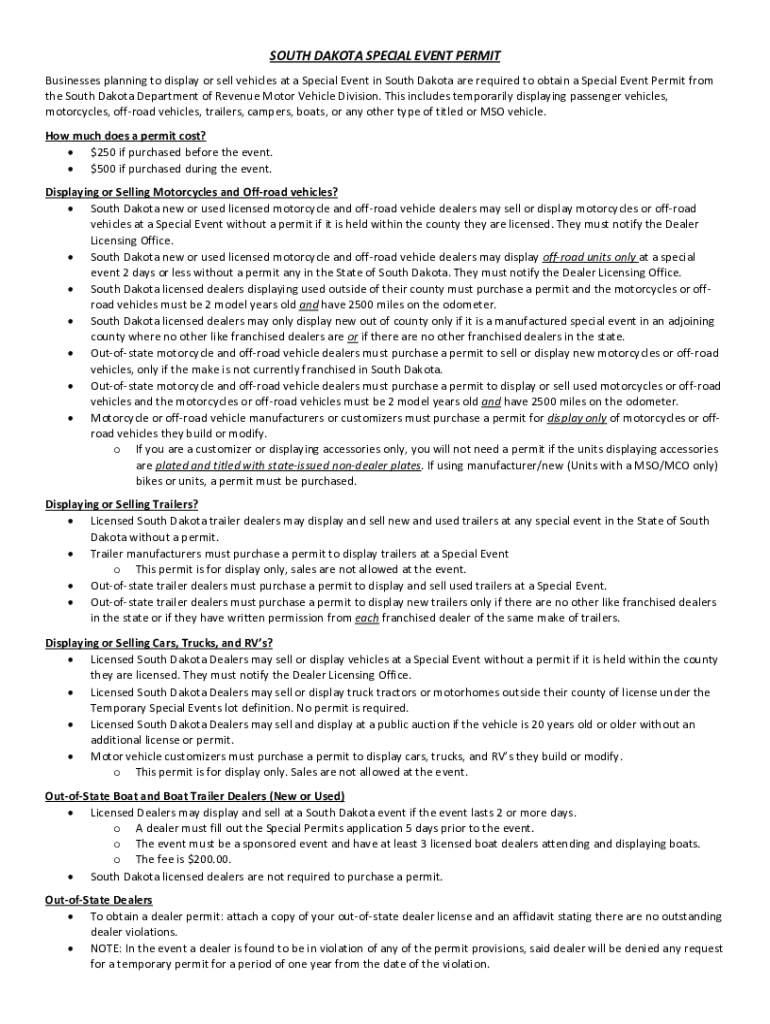

South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and.

Car Tax By State Usa Manual Car Sales Tax Calculator

With few exceptions the sale of products and services in South.

. Depending on what the dyed fuel is being used for will determine the tax rate that is paid. One field heading labeled Address2 used for additional address information. Counties and cities can charge an additional local sales tax of up to 2 for a maximum.

South Dakota charges a 4 excise sales tax rate on the. With local taxes the total sales tax rate is between 4500 and 7500. Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division.

Car sales tax in South Dakota is 4 of the price of the car. Different areas have varying additional sales taxes as well. The state sales tax rate in South Dakota is 4500.

The South Dakota sales tax and use tax rates are 45. South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average. Imposition of tax--Rate--Failure to pay as misdemeanor.

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. What is the sales tax on a. The vehicle identification number VIN.

The highest sales tax is in Roslyn with a. Rate search goes back to 2005. What Rates may Municipalities Impose.

1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. Repealed by SL 1990 ch 230 7. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

If the title being transferred to SD is from a state that has a state tax rate on vehicle purchases that is equal to or higher than 4 no tax will be due to SD as reciprocity will be given if the title. 4 State Sales Tax and Use Tax Applies to. If any motor vehicle has been.

Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of. South dakota charges a 4 excise sales tax rate on the purchase of all vehicles. All car sales in South Dakota are subject to the 4 statewide sales tax.

Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

South Dakota Codified Laws 32-5B-21 32-5B-21. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

South Dakota has recent rate changes Thu Jul 01. State Sales Tax plus applicable municipal sales tax applies to the selling price of dyed fuel when it is. One field heading that incorporates the term Date.

How To File And Pay Sales Tax In South Dakota Taxvalet

South Dakota Printable Temporary Plates Fill Online Printable Fillable Blank Pdffiller

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

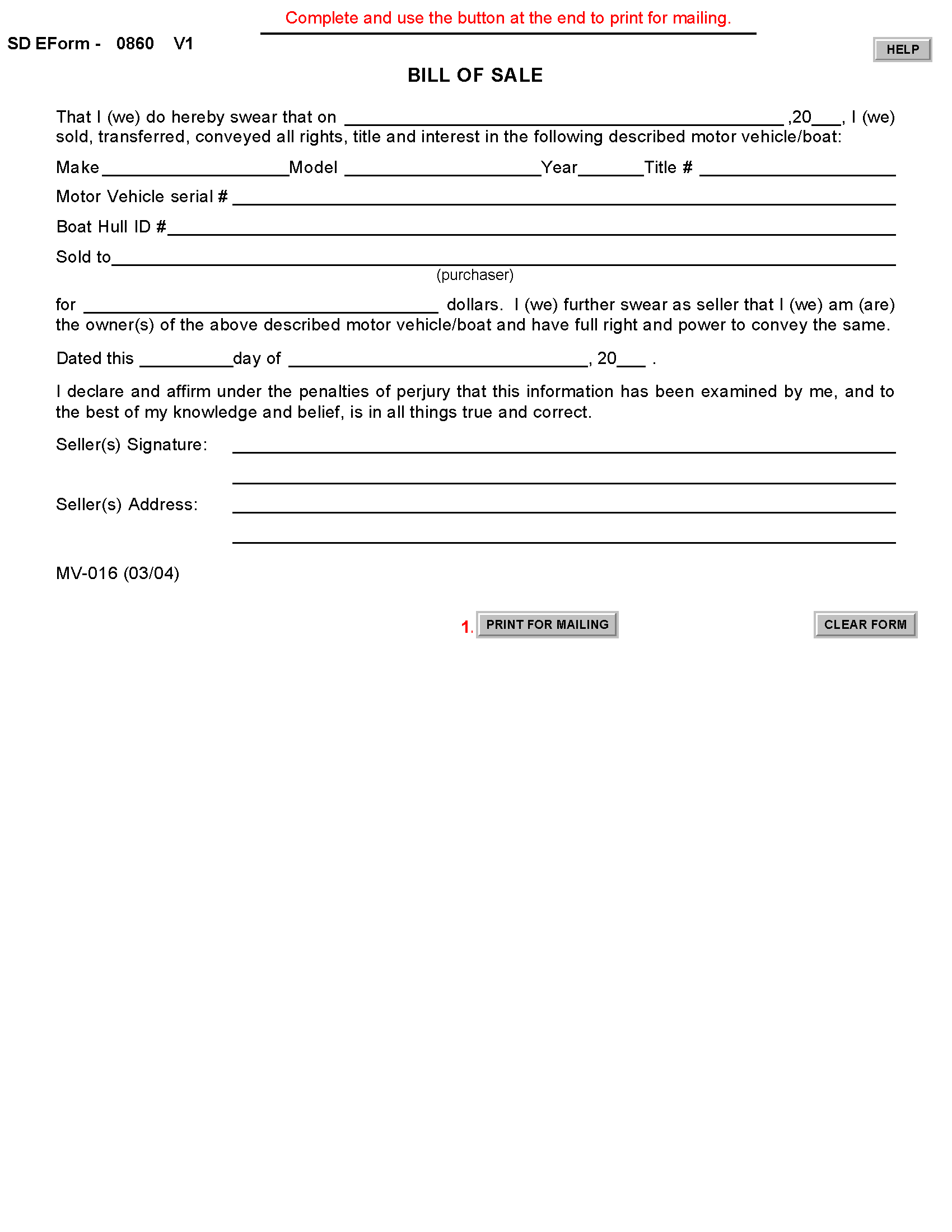

Free South Dakota Motor Vehicle Bill Of Sale Form Pdf Word

Sales Taxes In The United States Wikipedia

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

South Dakota Taxes Business Costs South Dakota

Your Guide To The United States Sales Tax Calculator Tax Relief Center

What S The Car Sales Tax In Each State Find The Best Car Price

States With The Highest Lowest Tax Rates

South Dakota Has Demand For Electric Vehicles But Not The Supply Or Energy Grid Sdpb

Municipal Sales Taxes To Go Unchanged South Dakota Department Of Revenue

Historical South Dakota Tax Policy Information Ballotpedia

Property Tax South Dakota Department Of Revenue

How Do State And Local Sales Taxes Work Tax Policy Center

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price